Rand report: Rand unable to escape the global sell-off after a sobering National Budget Speech

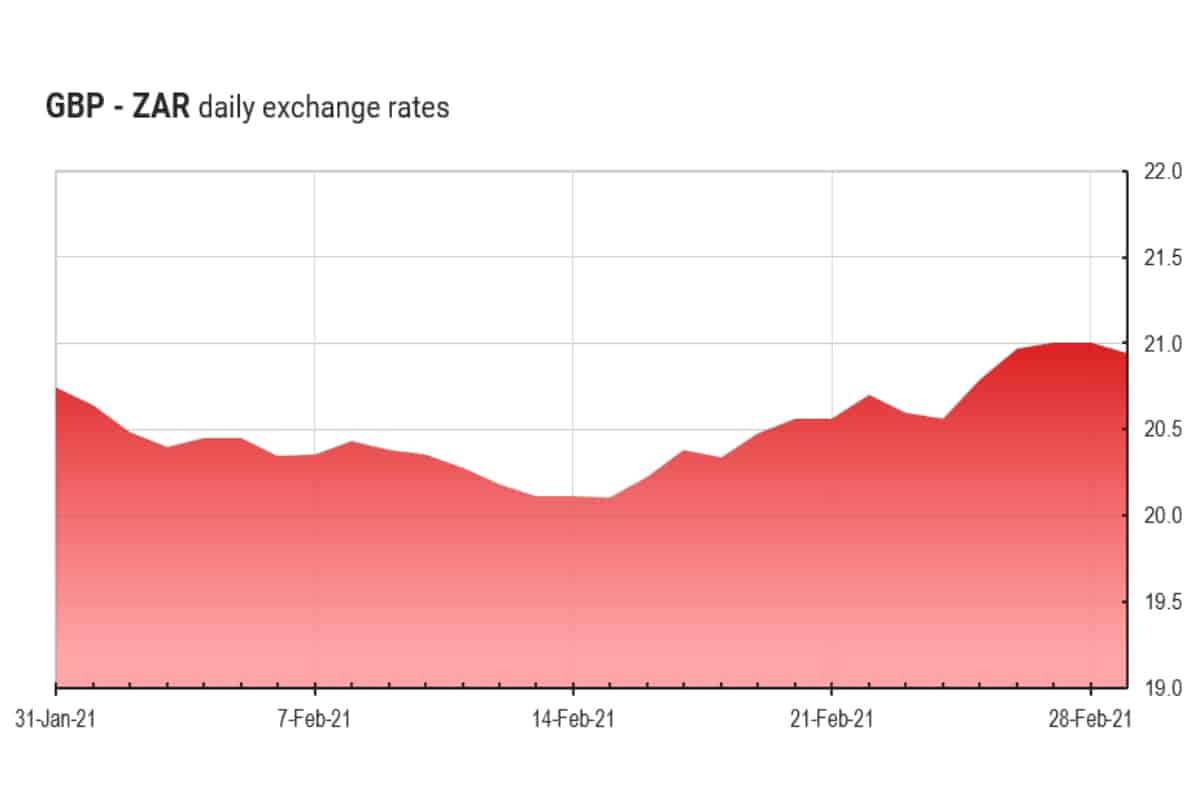

In both cases, however, markets experienced a correction shortly after. Any gains that the rand made in the beginning of the week were erased by a global sell-off on Thursday, fuelled by fears of rising interest rates. During weekly trade, the GBP/ZAR and USD/ZAR pairs appreciated by 2.45% and 3.06%, respectively.

South Africa’s National Budget Speech was fairly positive, for the taxpayer at least. Mboweni spared South Africans of significant tax hikes, indicating that the Treasury will no longer proceed with plans to raise an additional ZAR 40 Billion in taxes, as was announced in the October Medium Term Budget Policy Statement. Furthermore, South Africans saw a reduction in corporate tax to 27%, alongside a 5% rise in tax brackets. This relaxed fiscal position will hopefully aid in the restoration of GDP growth, which is estimated at 3.3% for 2021.

Mboweni also indicated that ZAR 19.3 Billion will be allocated to acquiring Covid-19 vaccines, with the aim to vaccinate 67% of the country by the end of the year. This is essential for South Africa to lift lockdown restrictions and return to a path of sustainable growth. Treasury has also allocated ZAR 94 Billion to employment creation and a further ZAR 791 Billion to invest in infrastructure.

Mboweni provided a word of caution, regarding the government’s rising debt burden. Since the beginning of the pandemic, budget shortfalls have been exacerbated. Gross loan debt has risen to ZAR 3.95 Trillion and is forecasted to reach ZAR 5.2 Trillion by 2023/2024. Debt repayments are now at ZAR 233 Billion, equating to 20% of tax revenue.

“We owe a lot of people a lot of money. These include foreign investors, pension funds, local and foreign banks, unit trusts, financial corporations, insurance companies, the Public Investment Corporation and ordinary South African bondholders.” – Tito Mboweni

After a fairly sensible and sober budget speech, the rand was rocked by a wave of global selling. Thursday saw equity markets trend downwards, as investors turned away from risk. The Chicago Board Options Exchange’s CBOE Volatility Index (CBOE VIX) was up 36.38% in a single day, as equity markets shed value and moved into the red for the week. Thursday saw the NASDAQ slip by 3.52%, alongside a 2.45% decline for the S&P 500. Emerging markets experienced a coinciding 2.28% intraday loss, before ending the week down by 6.61%. The JSE Top 40 also dipped by 2.66% during the week’s trade.

Thursday’s sell-off of risky assets did not favour the rand, which experienced single-day depreciation of 3.96% against the Dollar and 3.02% against the pound. The GBP/ZAR pair closed the week at R21.05 (up from R20.53 on Monday) while USD/ZAR closed at R15.10 (up from R14.65).

Weekly market events

Tuesday 2 March

- AU: RBA interest rate decision

- GER: Retail Sales (YoY) (Jan)

Wednesday 3 March

- UK: Rishi Sunak’s Budget 2021

Thursday 4 March

- AU: Balance of Trade (Jan)

- JPN: Consumer Confidence (Feb)

Friday 5 March

- CA: Balance of Trade (Jan)

- US: Non-Farm Payrolls (Feb)

- US: Balance of Trade (Jan)

No comments: